ORYZON Reports Financial Results and Corporate Update for the 4thQuarter and Year Ended December 31, 2019

MADRID, SPAIN and CAMBRIDGE, MA, UNITED STATES, February 24th, 2020 – Oryzon Genomics, S.A. (ISIN Code: ES0167733015, ORY), a public clinical-stage biopharmaceutical company leveraging epigenetics to develop therapies in diseases with strong unmet medical need, today reports financial results for the fourth quarter of 2019 and provides an update on recent developments.

"Oryzon continued to make strong clinical progress in the fourth quarter” said Dr. Carlos Buesa, Oryzon’s Chief Executive Officer. “We are encouraged by the promising efficacy seen in both our iadademstat oncology program and vafidemstat neurology program and importantly, these exciting signals of clinical activity were achieved with good safety and tolerability profiles. We look forward to a number of important milestones in 2020, including data readouts for our REIMAGING-AD and ETHERAL trials and the initiation of the Phase IIb PORTICO study evaluating vafidemstat in borderline personality disorder and also additional data on the ongoing cancer trials. We are confident that our two lead candidates are exciting potential treatment options in areas of high unmet medical need and look forward to continued clinical progress.”

Fourth Quarter and Recent Highlights

Iadademstat in oncology:

- New positive efficacy data from Phase II trial ALICE, investigating iadademstat in acute myeloid leukemia (AML) at the 61st ASH Annual Meeting and Exposition in Orlando, United States

- Reported objective responses in 6 out of 8 evaluable patients (75% OR): of these, there were 2 complete remissions (CR), 3 complete remissions with incomplete hematologic recovery (CRi) and 1 partial remission (PR).

- The mean follow-up time amongst the evaluable patients was 20 weeks, with a mean Time to Response (TTR) of only 32 days in those patients whith responded.

- Two of the 5 patients (40%) that had received more than 3 cycles of treatment had also become transfusion independent

- Encouraging preliminary efficacy data from the first 8 patients in the CLEPSIDRA Phase II trial evaluating the safety and clinical efficacy of iadademstat in combination with platinum/etoposide in second-line small cell lung cancer (SCLC) patients at the ESMO conference in Barcelona.

- Reported responses in 6 out of 8 patients (75% response rate), with 4 partial remissions and 2 long-term disease stabilizations in patients treated with iadademstat plus carboplatin/etoposide.

- Demonstrated durable treatment response with one partial remission patient at cycle 13 and still in response. This patient showed an initial 78.7% tumor reduction as determined by RECIST after 6 cycles of iadademstat plus carboplatin/etoposide. Tumor reduction continued upon iadademstat monotherapy after the combo cycles, with 3% of tumor reduction by RECIST at the end of cycle 12.

- The clinical trial continues to recruit patients and investigate dosing regimens to minimize hematological toxicity of the combination

Vafidemstat in neurological disease:

- Additional positive Phase IIa REIMAGINE efficacy data of vafidemstat in the treatment of aggression in three psychiatric diseases at the 2019 International College of Neuropsychopharmacology (CINP) meeting in Athens, Greece

- Reported data from ADHD, BDP and ASD and aggregated cohorts demonstrating statistically significant improvements in several scales measuring aggression such as the Clinical Global Impression (CGI) of Severity (CGI-S) and Improvement (CGI-I) scales and the Neuropsychiatric Inventory (NPI) 4-item Agitation/Aggression subscale

- Benefits also observed on several scales more generally assessing the global condition of the patients, such as the Neuropsychiatric Inventory (NPI) total score, the global BPD checklist (BPDCL) scale (for BPD patients) and the ADHD Rating Scale (ADHD-RS) (for ADHD patients).

- On the strength of these data, the company is currently preparing a Phase IIb trial in BPD (PORTICO trial), expected to start in 1H2020, and is evaluating additional Phase IIb studies in ADHD and/or ASD

- The company has completed the recruitment in REIMAGINE-AD, a Phase IIa trial evaluating the effect of vafidemstat to treat aggressiveness in moderate and severe Alzheimer's disease (AD) with a total of 12 patients. The company plans to report the results of this study at the AATAD/PD conference in April 2020 in Vienna, Austria.

- The company has completed recruitment of the Phase IIa ETHERAL trial in Europe, with 117 patients randomized, while it continues in the parallel US arm (ETHERAL-US). ETHERAL is a randomized, double-blind, 3-arm, parallel-group study with a 24-week placebo-controlled period followed by a 24-week extension in which placebo patients are randomized to vafidemstat therapy, to evaluate the safety, tolerability and preliminary efficacy of vafidemstat in patients with mild to moderate AD. Positive safety data from the first 104 patients in ETHERAL were presented at the 2019 Alzheimer's Association International Conference (AAIC-2019) in Los Angeles and the company plans to present initial interim 6-month treatment data from the EU trial also at the AAT-AD/PD conference in April 2020.

- The company announced that the extension phase of the SATEEN Phase IIa clinical trial evaluating vafidemstat in multiple sclerosis has been extended in patients with the secondary progressive form of the disease up to a maximum of 18 months of vafidemstat treatment. This extension will allow the assessment of the effect of vafidemstat as a therapeutic treatment for the progressive form of the disease which requires longer clinical observation periods.

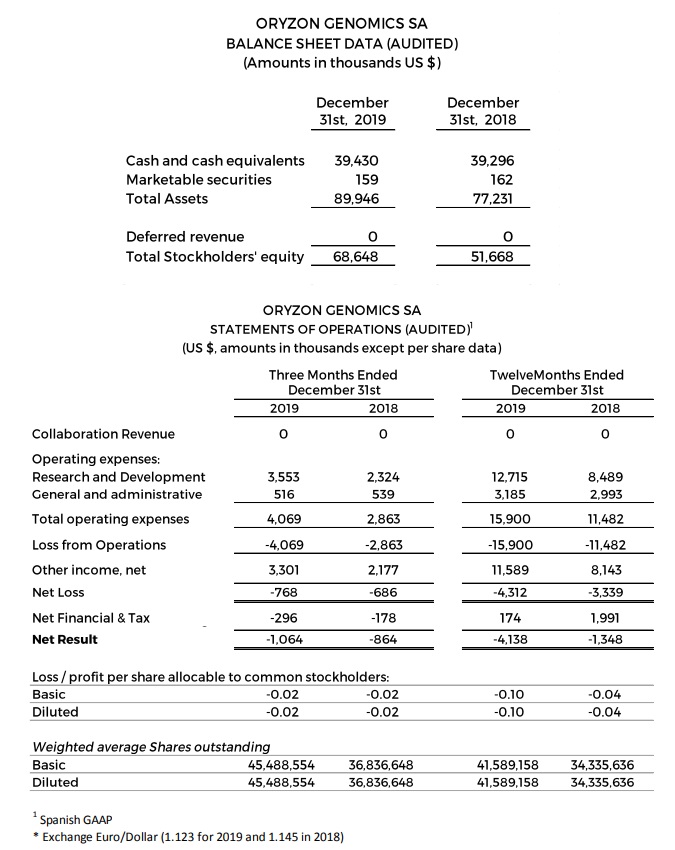

Financial Update: Fourth Quarter 2019 Financial Results

Research and development (R&D) expenses were $3.6 and $12.7 million, respectively, for the first 3 and 12 months ended December 31, 2019 compared to the $2.3 and $8.5 million for the first 3 and 12 months ended December 31, 2018. The $4.2 million increase was driven primarily by expenses associated with advancing the company’s clinical trials.

General and administrative expenses were $0.5 and $3.2 million, respectively, for the first 3 and 12 months ended December 31, 2019 compared to $0.5 and $3.0 million for the first 3 and 12 months ended December 2018.

Net losses were $0.8 and $4.3 million, respectively, for the 3 and 12 first months ended December 31, 2019, compared to net losses of $0.7 and $3.3 million for the first 3 and 12 months ended December 2018.

Negative net result of $4.1 million (-$0.10 per share) for the 12 first months ended December 31, 2019 as a consequence basically of -$1.7 million non-recurrent R&D tax deductions, compared to a negative net result of $1.3 million for the first 12 months ended December 31, 2018.

Cash, cash equivalents and marketable securities totaled $39.6 million as of December 31, 2019, compared to $39.5 million as of December 31, 2018.

About Oryzon

Founded in 2000 in Barcelona, Spain, Oryzon (ISIN Code: ES0167733015) is a clinical stage biopharmaceutical company considered as the European champion in Epigenetics. Oryzon has one of the strongest portfolios in the field. Oryzon’s LSD1 program has rendered two compounds, vafidemstat and iadademstat, in clinical trials. In addition, Oryzon has ongoing programs for developing inhibitors against other epigenetic targets. Oryzon has a strong technological platform for biomarker identification and performs biomarker and target validation for a variety of malignant and neurodegenerative diseases. Oryzon has offices in Spain and the United States. For more information, visit www.oryzon.com

FORWARD-LOOKING STATEMENTS

This communication contains, or may contain, forward-looking information and statements about Oryzon, including financial projections and estimates and their underlying assumptions, statements regarding plans, objectives and expectations with respect to future operations, capital expenditures, synergies, products and services, and statements regarding future performance. Forward-looking statements are statements that are not historical facts and are generally identified by the words “expects,” “anticipates,” “believes,” “intends,” “estimates” and similar expressions. Although Oryzon believes that the expectations reflected in such forward-looking statements are reasonable, investors and holders of Oryzon shares are cautioned that forward-looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Oryzon that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include those discussed or identified in the documents sent by Oryzon to the Spanish Comisión Nacional del Mercado de Valores (CNMV), which are accessible to the public. Forward-looking statements are not guarantees of future performance and have not been reviewed by the auditors of Oryzon. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date they were made. All subsequent oral or written forward-looking statements attributable to Oryzon or any of its members, directors, officers, employees or any persons acting on its behalf are expressly qualified in their entirety by the cautionary statement above. All forward-looking statements included herein are based on information available to Oryzon on the date hereof. Except as required by applicable law, Oryzon does not undertake any obligation to publicly update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise. This press release is not an offer of securities for sale in the United States or any other jurisdiction. Oryzon’s securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering of Oryzon’s securities to be made in the United States will be made by means of a prospectus that may be obtained from Oryzon or the selling security holder, as applicable, that will contain detailed information about Oryzon and management, as well as financial statements.